Getting Started

Getting Your Qenta Portal API Key

-

Getting Your Qenta Portal API Key: Contact our Support team, provide some information about your program, and we will generate access to the Qenta Embedded Finance Portal for you.

-

Accessing the Qenta Embedded Finance Portal: Once you have access to the Qenta Embedded Finance Portal, you can create and manage API keys. This enables you to start testing our platform and API immediately.

-

Schedule an Introductory Call: Request a 30-minute introductory call with our Sales team to further explore how our embedded finance offering aligns with your product. Additionally, you can email us at EF_sales@qenta.com with any inquiries you may have.

Defining Your Card Program

Your designated Qenta contact will assist you in defining the card program tailored to your specific use cases. To create your program, we’ll require the following information:

-

Basic Information About You and Your Customers:

-

What services are you currently providing?

-

Who is your target audience? Are you serving small business owners in France? Diaspora communities in Austria?

-

-

The Card Types You Wish to Issue:

-

Consumer Debit

-

Commercial Debit

-

-

The Account Structures Needed:

-

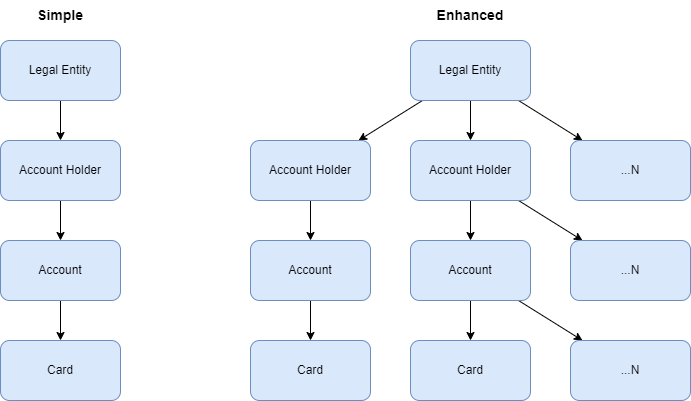

Simple

-

Enhanced

-

Providing these details will enable us to craft a card program perfectly suited to your requirements. Feel free to discuss any additional considerations or questions with your Qenta contact. We’re committed to ensuring your embedded finance solution aligns seamlessly with your business objectives.

Account Structure and Synchronization

When creating a new program, a defined bank account structure must be represented within the Qenta Embedded Finance Platform.

By default, our platform offers a simple setup, where one account holder corresponds to one balance account, with one associated card (1:1:1). However, based on your specific requirements, we also offer enhanced setups allowing for multiple account holders, balance accounts, and cards (n:n:n).

Should you require a custom setup, our team will collaborate with yours to determine the necessary steps for reserving and settling funds.

The outcome will be the establishment of account mapping and the seamless flow of funds, ensuring a streamlined and efficient process aligned with your program’s objectives. Should you have any questions or require further clarification, please don’t hesitate to reach out to us. We’re here to facilitate a smooth implementation process for you.

The Card Type

Once the account structure is established, we can proceed to define the type of card to be issued.

Card types are influenced by key program features such as deciding if physical or virtual cards will be issued, the country of issuance, and deciding on the individual card functions.

Physical cards are tangible products produced and shipped to the cardholder. They can be used for various purposes including e-commerce transactions, payment terminals, card present, point-of-sale transactions, and ATM withdrawals.

Virtual cards, on the other hand, are digital products without a physical form. They are displayed within your application to the cardholder and are primarily utilized for e-commerce, card-not-present transactions. Additionally, we offer the flexibility to convert virtual cards into physical cards if required by your program.

For further details, please refer to the Card Management section.

Your designated Qenta contact will assist you in determining the visual design and parameters of the card. Working closely with our key partners such as Mastercard, Visa, and our partner banking network, we ensure that your card design and associated marketing materials adhere to essential regulatory and marketing requirements. We’re here to support you throughout this process, ensuring a seamless and compliant card issuance experience.

Accessing the Qenta Embedded Finance Platform Test Setup

To facilitate your testing process, we will provide you with a test program that mirrors your defined card program. With this, you will gain access to:

-

The Qenta Embedded Finance Platform API:

-

Manage your resources seamlessly through our API.

-

Simulate transactions to test the functionality of your program.

-

-

The Qenta Portal:

-

Easily locate, view, and manage your resources within our test instance of the Qenta Portal.

-

These resources are designed to streamline your testing experience, ensuring that your embedded finance solution operates smoothly and meets your requirements. Should you encounter any issues or have questions during the testing phase, don’t hesitate to reach out to us for assistance. We’re committed to supporting you every step of the way.

Integrate With Us

Your designated Qenta contact and implementation specialist are invaluable resources to ensure a seamless technical integration process.

They will work closely with you to:

-

Understand Your Requirements: Your Qenta contact will gather detailed information about your specific needs and objectives.

-

Provide Guidance: They will offer expert guidance and support throughout the integration process, helping you navigate any technical challenges that may arise.

-

Facilitate Communication: Your Qenta contact will serve as a liaison between your team and ours, ensuring clear and effective communication at all times.

-

Ensure Smooth Integration: Together with our implementation specialist, they will oversee the integration process from start to finish, ensuring that all technical aspects are addressed and implemented correctly.

-

Address Concerns: If you have any questions, concerns, or issues during the integration process, your Qenta contact and implementation specialist will be available to provide assistance and resolve them promptly.

Rest assured, our team is dedicated to ensuring your technical integration with the Qenta platform is smooth, efficient, and successful. We’re here to support you every step of the way.

Prepare to Go Live

EU Region: Program Approval Process

Navigating the EU approval process for embedded finance can appear daunting, but with Qenta as your trusted partner, we’re dedicated to simplifying the journey. Here’s a comprehensive overview of the support we provide:

New Client Questionnaire and Consultation: to kick off the process, our implementation team will provide you with a comprehensive new client questionnaire. Our team will guide you through the completion process, ensuring all necessary information is provided.

Once the questionnaire has been finalized, a consultation session can be scheduled. During this discussion, we’ll review key aspects such as fund flows, legal entity structures, and BIN requirements. Our objective is to gain a thorough understanding of your business needs and requirements. Together, we’ll work towards aligning these with the requirements for approval from our BIN sponsor, TPL.

Partner Initiation: Once all the required details are discussed and received, our team will initiate the project with our BIN sponsor and processing partner. This collaborative effort is necessary for setting the stage for a smooth implementation process.

We’ll work together on technical setup tasks, including configuring the KYC/KYB flow, transaction rule suite, assigning BINs, and establishing transaction limits. These steps are important to ensure seamless integration and operational readiness. Throughout this process, our team will maintain clear communication and provide support to address any technical queries or challenges that may arise.

Marketing and Legal Review: As we progress, ensuring that your marketing and legal materials comply with regulatory standards is essential. Our team will conduct a thorough review of these materials in collaboration with you.

Together, we’ll assess your marketing collateral, website content, and legal documentation to ensure they meet industry regulations. Additionally, we’ll work closely on card design to ensure it aligns with your brand identity and regulatory requirements.

With Qenta’s embedded finance team, you receive tailored expertise and support at every stage of the EU approval process. From initial consultations to contract signing and compliance requirements, we’re dedicated to your success in the world of embedded finance.

US Region: Program Approval Process

We’re dedicated to making the approval process for our programs as smooth as possible. The approval process involves submitting detailed Commercial and Consumer program applications. Each application encompasses every feature the program will offer and our Qenta implementation team will work with you to complete these applications. Here’s what you need to know:

Program Application: Our embedded finance team will guide you through the process of submitting detailed applications for both Commercial and Consumer programs. No matter the complexity, we’re here to assist you every step of the way. Expect a 30-day approval timeline from our partner bank, during which our team will work diligently to ensure your application is processed efficiently.

Bank Approval: Once your program application is submitted, our team will ensure that it meets all requirements before proceeding to the next step. This involves obtaining approval from Patriot Bank, which requires the completion of three essential forms: Patriot Bank application, KYC/KYB assessment, and the collateral checklist. Rest assured, our experts will provide full support throughout this process, ensuring everything is handled smoothly and efficiently.

Cobrand Collateral: As part of the approval process, a collateral package must be prepared for review and approval. Our team will guide you through preparing the essential items such as card art, card mailer, FAQ, cardholder terms, privacy policy, e-sign disclosure, and any additional program-specific items. We’ll ensure that your collateral package meets all necessary criteria and is ready for submission to Patriot Bank.

With our dedicated support and guidance, you can be confident that the approval process will be efficient and seamless. Our embedded finance team is committed to helping you every step of the way, ensuring that your program is approved and ready for launch in no time.

Go Live!

Once you’ve successfully tested your integration with the platform and the program has been partner-approved, it’s time to go live!

This exciting step involves:

-

Final Checks: Before proceeding, ensure that all aspects of your integration have been thoroughly tested and meet your requirements.

-

Coordination: Coordinate with your Qenta contact and implementation specialist to schedule the go-live date. They will assist you in ensuring a smooth transition to the live environment.

-

Deployment: Deploy your integrated solution to the live environment, following any necessary steps provided by our team.

-

Monitoring: Monitor your system closely after going live to ensure that everything is functioning as expected. Be prepared to address any issues promptly, with the support of your Qenta contacts if needed.

-

Celebration: Celebrate the successful launch of your embedded finance solution! This milestone marks the culmination of your hard work and collaboration with Qenta.

Remember, our team is here to support you throughout the go-live process and beyond. If you encounter any challenges or have questions along the way, don’t hesitate to reach out to us for assistance. We’re dedicated to ensuring a successful and seamless transition to the live environment for your business.